Club Liability Insurance Program

CAPA’s Group Liability Insurance Program is designed to provide affordable coverage for CAPA Member Clubs across Canada. Offered through Co-operators, this insurance ensures that your club is protected against liability claims, giving you peace of mind while organizing events and activities.

Scroll down this page to see Frequently Asked Questions.

To register or renew your club’s participation in the program, fill in the registration form

Frequently Asked Questions

Q: What is covered under the Club Liability Insurance Program?

A: The insurance provides $5 million in liability coverage, protecting your club from claims related to bodily injury, property damage, or personal injury during club-organized activities and events.

Q: Who is the insurance carrier?

A: The insurance is offered through Co-operators, a trusted Canadian insurance provider.

Q: How much does the insurance cost?

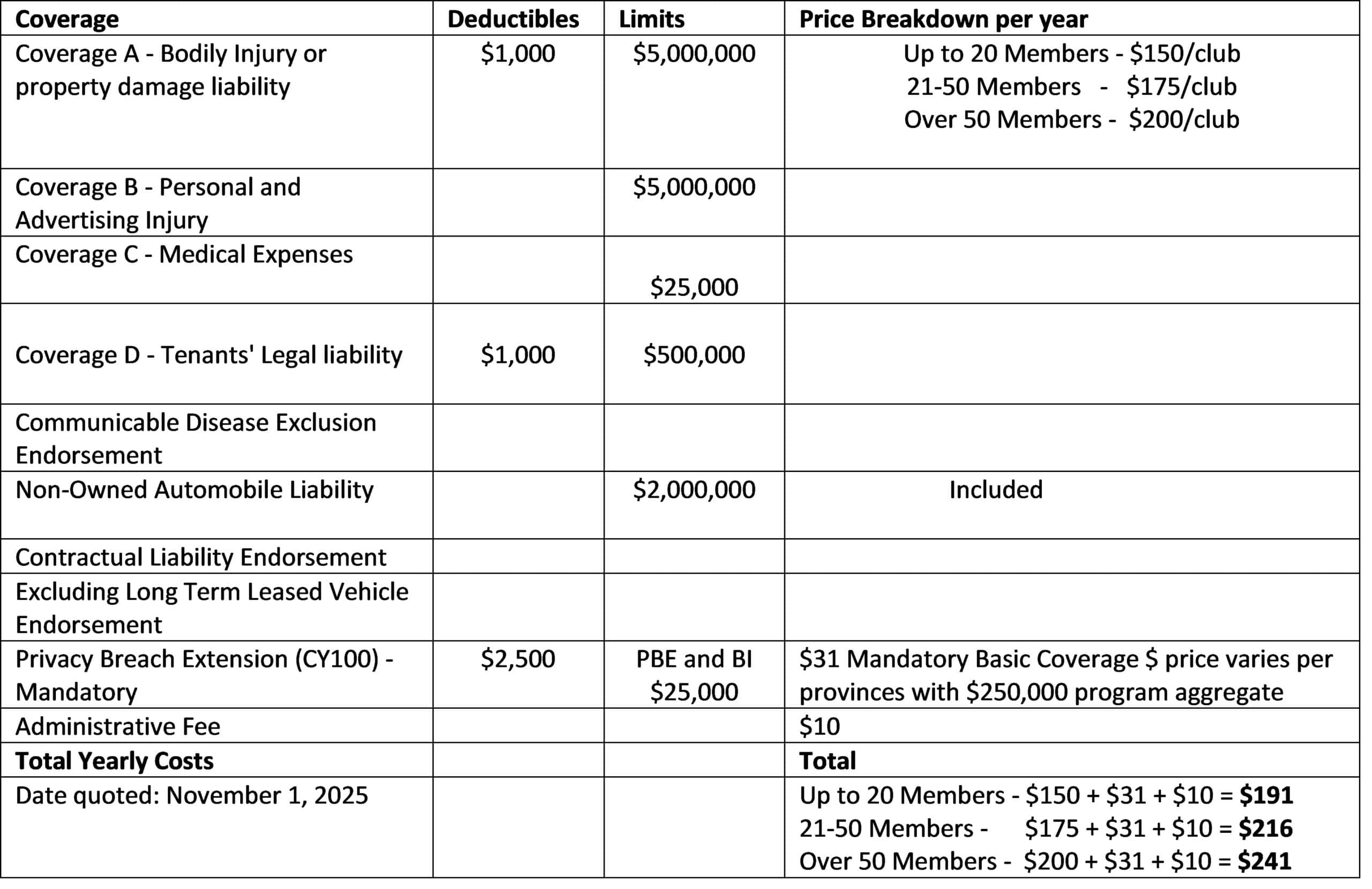

A: The cost depends on your club size:

- Up to 20 Members: $191

- 21-50 Members: $216

- Over 50 Members $241

Q: Why is CAPA charging a fee?

A: The fee is necessary to cover CAPA’s administrative costs for this program. This ensures that the program runs smoothly.

Q: Is the coverage for all club members?

A: Yes, the liability insurance covers your club as a whole, including all members while they are participating in club-organized activities.

Q: Does the insurance include Directors & Officers (D&O) Insurance?

A: No. To offer Directors & Officers (D&O) insurance, we would need at least 25 clubs that are registered non-profits to confirm their interest in this coverage. Currently, most CAPA clubs are registered as associations rather than non-profits and therefore wouldn’t qualify. However, if we do have 25 qualifying clubs interested, we’d be more than happy to work with Co-operators to offer D&O insurance.

Q: Is club equipment covered by this policy?

A: No. This insurance covers general liability only and doesn’t include coverage of club equipment.

Q: Our club’s current insurance expires at the end of November. If we choose to go with the CAPA Liability Insurance you propose, can we start our coverage at that time?

A: The liability insurance coverage starts on January 1, 2026. You will need to extend your club’s current coverage until the new coverage starts on January 1.

Q: Can the terms of the insurance be further customized to suit specific club conditions?

A: All clubs under the CAPA Liability Insurance Policy will have the same coverage. We cannot change anything unless changed for all clubs.

Q: Our club needs advice about how to make the transition from its current insurance coverage with the Cooperators.

A: If your club already has coverage with Co-operators, you can register for the CAPA Liability Insurance and work with Co-operators to obtain a pro-rated refund and ensure a smooth transition to the CAPA Policy without double coverage.

If you are with a different insurance company, you can ask them for a refund. If you decide to only register with the CAPA policy in the spring of 2026, you will still need to pay the full amount and then renew again in January 2027. The pricing has no prorated pricing.

Q: How much will our club pay in taxes in Nova Scotia?

A: Insurance policies are taxed only on a certain portion of the premium and tax rates vary by province and. Upon receiving your application, Co-operators will calculate the tax portion of your premium and notify you of your exact payment, you may then decide to purchase it or not.

Q: When and how do we pay for the insurance?

A: Once your club is registered for CAPA Liability Insurance, Co-operators will calculate the exact amount of your payment. You can then pay CAPA via e-transfer, Payal, Cheque or Credit Card over the phone. We will provide instructions for the payment method you choose. Payment is due by the end of day December 15, 2025.

Q: Is this insurance mandatory for CAPA clubs?

A: Participation in the insurance program is voluntary, but it is highly recommended for clubs to protect against potential liability claims during events or activities.

Q: Can we cancel the insurance during the year?

A: The insurance is annual and non-refundable once payment is made. However, you can choose not to renew the following year.

Q: What happens if our club grows during the year?

A: If your membership numbers increase, please notify CAPA, but the cost of the insurance will remain the same for the duration of the coverage period.

Q: When does the insurance coverage begin?

A: Coverage will start on January 1, 2026, and renew annually. Co-operators will notify you when your club’s insurance is active.

Q: What should our club do to make the transition from our current insurance proivider?

A: Once you have paid for CAPA Liability Insurance, you should cancel your existing liability insurance policy in order to have a smooth transition from one coverage to another.

Q: Our club has a paid administrator. Is this person covered by the CAPA Liability Insurance policy?

A: If your club’s paid administrator is an independent contractor, as defined by Employment and Social Development Canada, they are not covered by CAPA’s General Liability policy. If your paid administrator is an employee of your club, they would be covered by CAPA’s General Liability policy.